- July 17, 2020

- Posted by: innovety

- Category: Bookkeeping

Contents:

CPAs must stick to certain ethical standards when managing their clients’ assets. There are several decisions that you must make to guarantee your financial success. Hiring the best CPA near me for small businesses is one of them, if not the most important. Therefore, you must consider the communication skills, technical expertise, and professional ethics of the CPA before deciding on hiring one.

When transferring data from the European Union, the European Economic Area, and Switzerland, We rely upon a variety of legal mechanisms, including contracts with our customers and affiliates. Department of Commerce regarding the collection, use, and retention of personal information transferred from the European Union, the European Economic Area, and Switzerland to the United States. We collect and use the personal data described above in order to provide you with the Services in a reliable and secure manner. We also collect and use personal data for our legitimate business needs. To the extent we process your personal data for other purposes, we ask for your consent in advance or require that our partners obtain such consent. I understand that the data I am submitting will be used to provide me with the above-described products and/or services and communications in connection therewith.

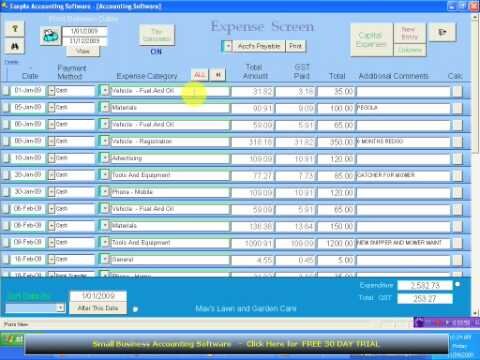

Small Business Accounting

Whether you are a business owner or an individual searching for a CPA, you can be audited at any time, so hiring a CPA in Pembroke Pines may be the best thing you can do for yourself. A CPA provides you with proper representation in an audit. Unfortunately, a non-certified accountant is not qualified to provide this type of representation. Typically, a CPA in Miami is likely to be more educated and experienced in the field of accounting than someone noncertified.

A CPA is a designation earned after completing some educational and work requirements and they can perform some duties that a non-certified accountant is not allowed to do. Here is some information to help you choose what is best for you and your business. It should go without saying that you want your accountant to be good at what they do, but there’s more to proficiency than a title on a business card. To carry the title of CPA, accountants must meet additional education and experience requirements as well as pass an exam. Certified Public Accountants are the most qualified professionals when it comes to performing detailed and strategy-based analysis and forecasting around your company’s financial data.

Some clients might find it valuable to be able to meet with their CPA in person. Even with the ubiquity of online meetings through technologies such as Zoom, this face-to-face aspect can be an important factor. However, remember that CPAs can work from anywhere provided that they have the appropriate expertise, meaning that geography need not limit your choice. As a general contractor in my first year of business, I needed help. I highly recommend ProAdvisor CPA for any personal or business needs when it comes to bookkeeping, accounting, and tax.”

You’ll find that the information you gather will be very helpful in your efforts to find the right CPA for your needs. What services do you perform for your clients and which do you most enjoy? This is a helpful way to get to know your CPA better while also making sure they typically provide the services you are seeking. Let an expert do your taxes for you from start to finish with TurboTax Live Full Service. Or get your taxes done right, with experts by your side with TurboTax Live Assisted.

It can get complicated, but click the link if you want to learn more about the e-file mandate. Choosing the best tax professional for you will greatly depend on what it is that you need help with. It can also help prevent possible IRS penalties or audits in the future. In addition, you can expect a CPA to help you beyond just preparing and filing your tax returns.

Often the best way of finding a good accountant is to get a referral from a friend or business colleague. Also check with Society of Certified Public Accountants in your state, which can make a referral. We erase the hassle of miscommunication and confusion by providing everything you need from one firm. Simplify your financial situation with one firm that manages your bookkeeping, payroll, and taxes for you. The next step is to get them plugged into our own word class network of financial professionals — the same team that personally handles Garrett’s finances.

Maybe it’s time to hire a Certified Public Accountant . This is really a question for you and not your potential tax advisor. It is not necessary for your accountant to be local given the ease with which you can send documents via email and Dropbox. It really comes down too whether you need to actually see your accountant to get comfortable with her advice. A recent marriage or divorce, the birth of a child, a career change, or an especially generous bonus can all have a significant impact on your tax liability and personal financial goals.

Support

NEW BUSINESS ADVISORYNew business advisor and incorporation services helping you get off on the right foot. That sounds great, but the key to putting the benefits of a business accountant to use is finding the right accountant for your company. When you first consider hiring a CPA firm, you will most likely begin with an online search. This is a great place to start, but it is essential to do your due diligence before making any decisions.

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

In addition to taking the test, https://bookkeeping-reviews.com/s fulfill continuing education requirements to keep their licenses active and stay up to date on all federal, state and local tax laws. If they’re going to prepare your taxes, make sure they have a Preparer Tax Identification Number . Investment advisory services are provided by Wealthfront Advisors , an SEC-registered investment adviser, and brokerage products and services, are provided by Wealthfront Brokerage LLC, member FINRA / SIPC. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

How to Choose the Right CPA: Questions to Ask

Each year, the I.R.S. compiles a “Dirty Dozen” list of tax scams. The best time to interview CPAs is in the summer and fall, when they aren’t quite as busy and are likely to have more time to focus on getting to know you better as well. Due to the demanding education and testing requirements that a CPA must fulfill, you’ll find that their expertise goes beyond just preparing and filing an accurate tax return on your behalf. I once hired a CPA who used to be the top accountant for our governor’s office.

When it comes to financial planning and filing taxes, it’s important to choose the right accountant for your needs. Enrolled agents, CPAs, and tax attorneys all have different qualifications and areas of expertise. All can handle your tax return needs, while CPAs and tax attorneys can provide other valuable services like representing you before the IRS or Tax Court, or even helping your business with other administrative tasks. If you’re a start up or entrepreneur looking for an accounting firm with all of the qualities mentioned above, give us a call and let us show you how we’re different . Kruggel Lawton provides assurance, tax, valuation, and advisory services to a wide range of family-owned, privately held companies.

Some CPAs may charge by the hour for advice during the year. A good working relationship entails reasonable expectations from both parties. Make sure that you are able and willing to provide what you need to your CPA so that they can do their job efficiently. But in general, you’ll want to consider the following factors when making this important decision. Furthermore, your CPA should use more than one medium of communication.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

The key thing to query during the hiring process is how an accountant will add financial value to your company. You want them to demonstrate the skills and knowledge of supporting a small business. Thinking for you and your business, Experienced full-service accounting, tax and management advisory services. If you are happy with a firm’s credentials, take some time to learn about the key players in the company. What is their professional background, and what qualifications do they hold?

Below, 16 members of Forbes Finance Council shared their tips for finding one that’s right for you. More deductions in TurboTax Self Employed based on the median amount of expenses found by TurboTax Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry.

Furthermore, consider their how payroll outsourcing works in working with clients in your industry. Specialties are based on services provided or industries served. At Sharon H. Lyall, CPA, our expertise and experience are in the unique area of business property taxes. We are adept at handling business property taxes for franchises such as hotels, fast food companies, and manufacturing companies.

Make sure that the CPA’s personality and expertise match your needs. If you are interested in the services that CPAs provide, this short guide can offer you some basic tips on how to choose and use a CPA. There are also specialized accountants for businesses such as medical offices, dental offices, veterinarians, construction, and more. Read on to learn what to look for so that your business flourishes.

We deploy automated technologies to detect abusive behavior and content that may harm our Services, you, or other users. Our Services are designed to make it simple for you to store your files, documents, comments, messages, and so on (“Your Stuff”), collaborate with others, and work across multiple devices. To make that possible, we store, process, and transmit Your Stuff as well as information related to it. Our Services provide you with different options for sharing Your Stuff. Staying informed about upcoming changes in the finance industry as well as government regulations making sure your company updates policies and procedures as required.