- September 1, 2021

- Posted by: innovety

- Category: Forex Trading

Contents:

However, there are some signals you can retrieve from the harami pattern. Read this article to learn how to use the harami candlestick pattern. The bullish harami pattern and the engulfing reversal pattern are quite similar, especially in the outcome.

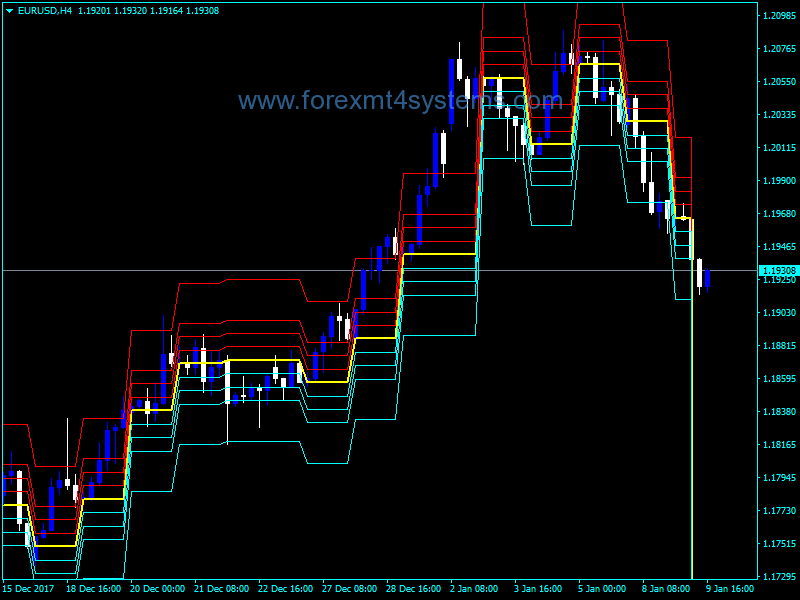

Such a strategy is often an indicator for traders of a trend reversal. It tells them it would be valuable to do more analysis to purchase or sell their existing investment but will not always need action following the original indicator. If the trend is moving down and begins to switch with the Doji centered in the previous candlestick, it is considered a bullish pattern/reversal. If the trend is moving upward and then begins to flip with the Doji again within the last stick candle, it is considered a bearish pattern/reversal. Depending on where the trend is moving, the pattern can signal either a bullish or bearish reversal. As seen in the GBP/USD 30-min chart, the RSI crossover occurs exactly at the same time when the bullish harami appears and is above the 30 level.

Recently, we discussed the general history of candlesticks and their patterns in a prior post. We also have a great tutorial on the most reliable bullish patterns. After a steady price increase, a bearish harami develops which is shown in the green circle on the chart. At the same time, the stochastic at the bottom of the chart has already been in the overbought area for about 7 periods. The price breaks the yellow support in a bearish direction giving us the confidence to hold our short position.

Latest Bullish Harami Formations

In this, you will be waiting for confirmation that the reversal will happen. A bearish harami is a candlestick chart indicator for reversal in a bull price movement. A bearish pattern shows a potential future downward trend. It occurs after an upward trend with a long upward candle meaning the buyers are in control. The upward candle is then followed by a doji which, similarly to before, must be within the previous candle’s length. It represents indecision from the buyers and potential change of momentum because the doji “gaps” open closer to the mid-range of the previous candle.

Bearish Harami: Definition and Trading Strategies – Investopedia

Bearish Harami: Definition and Trading Strategies.

Posted: Sun, 26 Mar 2017 06:38:27 GMT [source]

Here, the https://g-markets.net/ trade will be initiated if the price moves above the shadow. Analysts looking for fast ways to analyze daily market performance data will rely on patterns in candlestick charts to expedite understanding and decision-making. Nonetheless, when you are able to find the boundaries of the previous trend, Fibonacci support and resistance levels can help you confirm the trend reversal and find the right entry level.

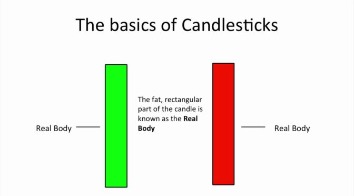

Suddenly, Facebook’s price breaks the pennant to the downside and thus we continue to hold our short position. The double top that came in the form of a bearish engulfing candlestick gave us that added confirmation that we really did see a top of some sort. The harami cross is a more powerful version of the harami. It is characterized by having a very small real body almost to the point of being a doji. The risk-averse can initiate a long trade at the close of the day after P2, only after confirming that the day is forming a blue candle. In case of a bearish harami, you should place a sell-stop slightly below the bigger candlestick.

What is a Harami Cross Candle?

Learn about crypto in a fun and easy-to-understand format. Gordon Scott has been an active investor and technical analyst or 20+ years.

What is a Marubozu Candlestick?

A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.

The small blue candle on a standalone basis looks harmless, but what really causes the panic is that the bullish candle appears suddenly when it is least expected. The market gains strength on P2 and manages to close on a positive note, thus forming a blue candle. However, P2’s closing price is just below the previous days open price. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. The Bearish Engulfing pattern is a two-candlestick pattern that consists of an up candlestick followed by a large down candlestick that surrounds or “engulfs” the…

Trading Setups Review

We exit the position and collect a profit of $.30 cents per share for 25 minutes of work. If you use the money flow or the price oscillator, the chance to match a Harami with an overbought/oversold signal is minimal. The stochastic oscillator on the other hand is great for trading haramis. However, the blue lines at the end of the chart show how the price confirms a double bottom pattern.

Any conclusions you may get from this pattern can be false even if you do everything right. Combining harami with other tech analysis tools is better for confirming or refuting your calculations based on the harami candle. The Harami candlestick pattern is used to spot trend reversals.

Once you have your dataharami candlestick, you can measure your success. Then you will have confidence to take the trade knowing your ratio of wins to losses. Now that we are short Citigroup, we wait for an opposite signal from the stochastic.

- That’s the reason a third confirmation candle is required to be absolutely sure that the bullish pattern is now initiated and has a good chance that it may continue for some time.

- Risk takers can initiate a long trade around the close of the P2 candle.

- If you have an uptrend and you get a bearish harami candle, try confirming this signal with the stochastic.

- Most indicators signal the upcoming trend reversal, and others show that the market is consolidating, but today we will speak about an indicator with a kind of ambiguous reputation.

- A chart formation is a recognizable pattern that occurs on a financial chart.

Learn how to trade forex in a fun and easy-to-understand format. It is generally indicated by a small decrease in price that can be contained within the given equity’s upward price movement from the past day or two. It is generally indicated by a small increase in price that can be contained within the given equity’s downward price movement from the past couple of days. The Structured Query Language comprises several different data types that allow it to store different types of information… We use the information you provide to contact you about your membership with us and to provide you with relevant content.

How to Trade with the Harami Candlestick?

Just like the Bullish Harami pattern, after noticing this trend, you should look for a confirmation which will ideally show up as a bearish candlestick right after the Bearish Harami pattern. If you get a confirmation, this should trigger a sell signal which could be a sign for investors to pull out of the market. The first Harami pattern shown on Chart 2 above of the E-mini Nasdaq 100 Future is a bullish reversal Harami.

Technical Classroom: How to read Bullish Harami and Bearish Harami patterns – Moneycontrol

Technical Classroom: How to read Bullish Harami and Bearish Harami patterns.

Posted: Sun, 14 Oct 2018 07:00:00 GMT [source]

First, you need to identify an existing bullish or bearish trend. If a bearish harami cross and the trader are entering a short position, they can place a stop-loss above the original candlestick. Similarly, if the trend does not switch, the investor will incur less loss. “Take profit” targets can also be used to help traders exit a trade profitably. The harami cross pattern does not show profit targets through such a strategy.

In the case above, Day 2 was a bullish candlestick, which made the bullish Harami look even more bullish. The bearish harami pattern appears at the top end of an uptrend, allowing the trader to initiate a short trade. Still, the best approach to use the harami pattern is to combine it with several parts of technical indicators like moving averages and Bollinger Bands. You can look at this article to see some of the most common reversal indicators you can use in the market. The size of the second candle determines the pattern’s potency; the smaller it is, the higher the chance there is of a reversal occurring. The opposite pattern to a bearish harami is a bullish harami, which is preceded by a downtrend and suggests prices may reverse to the upside.

As the name suggests, it has it is made up of a large bullish or bearish candle that is followed by a smaller one of the opposite colour. A bearish harami is a two bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. Identifying the bullish harami pattern on a trading chart is fairly straightforward and easy. However, finding the pattern is usually not enough and you’ll need to combine it with other indicators in order to confirm the pattern.

Which candlestick pattern is most reliable?

According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.

Its first bar was a wide-range bullish trend bar that was likely exhaustive. This bullish Harami candlestick pattern overlapped with the 300% line. It offered an excellent opportunity to take on a bullish position with limited risk. All ranks are out of 103 candlestick patterns with the top performer ranking 1.

Partnerships Help your customers succeed in the markets with a HowToTrade partnership. Trading analysts Meet the market analyst team that will be providing you with the best trading knowledge. Trading academy Learn more about the leading Academy to Career Funded Trader Program. The MACD divergence gave further support for a long setup.

Which candlestick pattern is most reliable?

According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.