- January 26, 2023

- Posted by: innovety

- Category: Forex Trading

Contents:

From tutorials and featured articles to fully fledged https://trading-market.org/ courses, CAPEX is a leading educational broker. Featured articles are produced by our team of industry experts and cover a wide range of topics. Learn about emerging markets, unique trading strategies, or general finance news. Our CAPEX trading courses are comprehensive and ensure new traders have all the skills and knowledge to help them succeed.

MT5 customization: How to personalize your trading experience – Business Insider Africa

MT5 customization: How to personalize your trading experience.

Posted: Wed, 29 Mar 2023 12:38:22 GMT [source]

This is where they use the two together in a deal to predict the next price action. Technical analysis is where a trader looks at charts and determines the next price action. By definition, fundamental analysis is the study of economic, social and political factors that affect the supply and demand of an underlying financial asset.

Sentimental Analysis

Before concluding this article, I wanted to share few trading and investment resources that I have vetted, with the help of 50+ consistently profitable traders, for you. I am confident that you will greatly benefit in your trading journey by considering one or more of these resources. Foreign Investment– Higher interest rates will likely attract foreign investors to a country, which can help strengthen the price of a currency over time. Flags– Flags will be constructed using two parallel trendlines in the middle of a prevailing trend.

Other avenues of study types of technical analysis in forex correlations between changes in Options and put/call ratios with price. Also important are sentiment indicators such as Put/Call ratios, bull/bear ratios, short interest, Implied Volatility, etc. So, if you are trying to predict the future, you need a plan and a technique to do that, right?. With that in mind, let’s get a quick look at two of the most widely used trading techniques among forex traders – technical analysis and fundamental analysis. Across the industry, there are hundreds of patterns and signals that have been developed by researchers to support technical analysis trading.

- Technical analysis focuses on strategies such as scalping and day-trading, whereas fundamental analysis focuses on long-term swing and position trading strategies.

- Trading software varies based on who creates it and how it is to be used.

- The volume indicator is below the chart; two moving averages (10-day and 30-day) are drawn over the candles inside the chart.

- While this software may not be ideal for day traders, swing traders and investors will find thesoftware’s capabilities in the creation of watchlists and price action analysis useful.

- He followed his own trading system (he called it the ‘market key’), which did not need charts, but was relying solely on price data.

We have adopted a very simple way of trading when the economic or earnings data is released. We always stay out of the market two hours before the data is released. Then, we enter certain assets 30 minutes after the data has been released.

Volume-based indicators

In 1948, Robert D. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Charles Dow reportedly originated a form of point and figure chart analysis. With the emergence of behavioral finance as a separate discipline in economics, Paul V. Azzopardi combined technical analysis with behavioral finance and coined the term “Behavioral Technical Analysis”.

With technical analysis an investors tries to determine how the supply and demand of an asset affects its price, trading volumes, and liquidity. The two types of market analysis – fundamental and technical – provides important information about the price of an asset, and the condition of the sector or industry it is in. That can be either macro data, such as GDP and employment reports, or microdata that is specific to one company such as the P/E or P/S ratios. Technical market analysis looks at the historical price action of an asset, seeking to identify patterns that can be used to locate potentially good entry and exits points for trades.

Scientific technical analysis

Contrarily, if the stock is artificially breaking out due to a paid promotion, you may take another approach. This can help you identify significant price points and get a better understanding of the mentalities of other traders. For example, $5.30 may not be a significant price on an intraday chart, whereas it may have major significance on a daily chart. A stock can have different trends across different time frames and you need to pay attention to the trends that are most relevant to your trading style. For example, a stock may be in a yearlong uptrend, making for a nice investment opportunity.

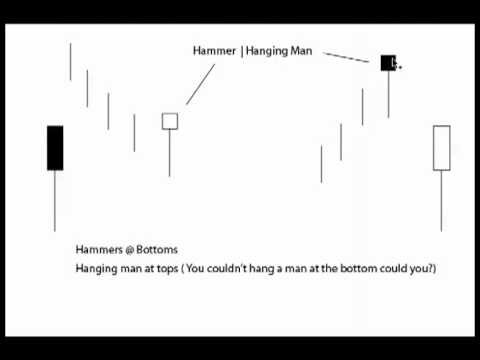

The second candle in the pattern should be bigger than the previous candle and should cover the ‘body’ of the previous candle. The bigger the second candle and the higher it advances, the stronger the signal. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk.

Fundamental analysis is used to predict how supply and demand will affect the price of specific commodities. It can determine what is the intrinsic value of a commodity asset and provide an outlook into its future value. When conducting technical analysis there are clear signals when to buy or sell but fundamental factors don’t provide that luxury. Technical traders trade on momentum and usually enter into positions of a shorter time span, where fundamental analysts value finding long-term potential. Fundamental analysts look at the economic factors that affect how an asset performs which can highlight if it is trading higher or lower than its real price value. Public data is used to conduct the analysis from a macro to micro perspective.

Some traders might look for trends on a chart while other traders might look to see if demand might be increasing for a commodity. It’s best to start with reading weekly or monthly charts, as long-term patterns give a good overview and perspective, as short-term views can often be misleading. Once the experience is there, it’s easier to investigate and read intraday charts. On charts, resistance lines are visualized as horizontal and start at the recent most extreme price peak, with the line pointing toward the future on the time axis. Likewise, support lines are horizontal lines that start at the recent extreme low price and point toward the future. Thousands of indicators exist, and traders should work out the best ones for their trading style and strategy, and understand what they are and how they work.

FXChoice taps Acuity’s news, sentiment tools, calendars, trade ideas … – FinanceFeeds

FXChoice taps Acuity’s news, sentiment tools, calendars, trade ideas ….

Posted: Wed, 29 Mar 2023 10:29:00 GMT [source]

At each extreme, though, there are those who use pure technical analysis and others who are solely fundamental traders. Chart patterns and technical indicators are the 2 different ways of evaluating the price charts and market behaviour. Even though technical analysis may seem intimidating at first, there are various ways to learn it. The first step would be to start with the basics, read about investing, how the markets, stocks, and the economy works, and gain a thorough understanding of the core concepts. Some main types of technical indicators include trend following, oscillators, volatility, and support and resistance, which are grouped based on their function. While there are various forms of technical trading analysis, using chart patterns to analyze human emotions’ effect on prices is still relevant as it illustrates specific price fluctuations.

Crazy Benefits of Fundamental Analysis (Even for Day Trader)

GDP data is released regularly, and it’s the percentage change from the last figure that traders and analysts care most about. For forex traders, that’s often enough – after all, a currency’s value is a reflection of its economy. Risk management is crucial to all forms of trading, and fundamental analysis is no different. Essentially, fundamental analysis works by examining data to decide an asset’s fair value. I am not going to lie to you, only a small percentage of currency traders are successful in the long-term.

- All the historical price action and economic figures are there – all you have to do is put on your thinking cap and put those analytical skills to the test.

- In a 2000 paper, Andrew Lo back-analyzed data from the U.S. from 1962 to 1996 and found that “several technical indicators do provide incremental information and may have some practical value”.

- Unlike technical analysis, which looks purely at price action and trends, fundamental analysis takes on a much more rigorous assessment.

When you trade forex, you are trying to predict the future price movements of various currency pairs. As the most important aspect of day trading, technical analysis is a tool and strategy for identifying price movement for any of the tradable assets on offer at CAPEX. Technical analysis at CAPEX involves using the WebTrader and MetaTrader 5 platforms in-built trading tools. With technical analysis, traders at CAPEX can identify reversals, see price movements, and predict when to enter and exit a trade. The CAPEX free demo account it’s the best tool for practicing technical analysis and it’s one of many reasons to sign up to CAPEX today. These signals can help investors accurately forecast future price movements and know whether to buy, hold, or sell their assets.

In addition to all this, you can use key tools provided by most brokers to conduct stock analysis in stocks. Some traders rely solely on TA, and can be referred to as Technical Analysts. If a traders were to then use technical analysis to perform actual trades in the market, they could in turn be called Technical Traders.